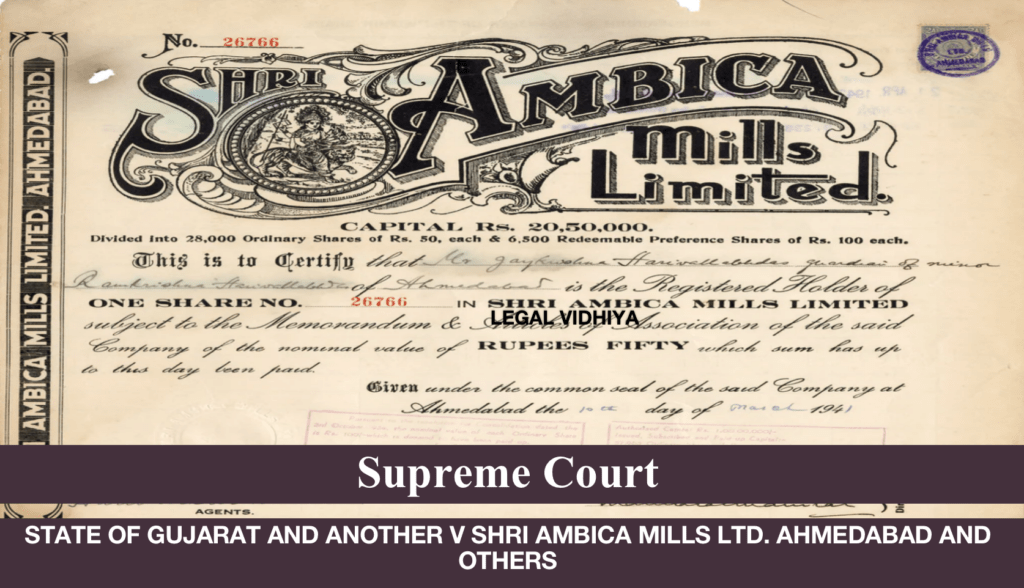

STATE OF GUJARAT AND ANOTHER V SHRI AMBICA MILLS LTD. AHMEDABAD AND OTHERS, AIR 1974 SC 1300, (1974) 4 SCC 656

| CITATION | AIR 1974 SC 1300 : (1974) 4 SCC 656 |

| DATE | 26th March, 1974. |

| COURT | Supreme Court of India. |

| CASE TYPE | Civil Appeal. |

| CASE NO. | Civil Appeal Nos. 1931-1933 of 1968, 2271 of 1968, 492-512 of 1969, 1114-1129 of 1969 |

| PETITIONER | The State of Gujarat and Another. |

| RESPONDENT | Shri. Ambica Mills Ltd, Ahmedabad and others. |

| BENCH | K.K Mathew, A.A Ray (CJI), H.R Khanna, Y.V Chandrachud, A. Alagiriswami. |

| REFERRED | Article 19(1)(f), Article 13(2), Article 14, Article 226 of The Indian Constitution 1950; Section 3, Section 6, Section 7 of The Bombay Welfare Fund Act, 1953; Rule 3 and Rule 4 of the Bombay Labour Fund Rule, 1953; Bombay Labour Welfare Fund (Gujarat Extention and Amendment) Act, 1961. |

BACKGROUND

The case deals with the application and non-application of the fundamental rights of the Indian Constitution. Whereas the State of Bombay was bifurcated into two states, Gujarat and Maharashtra in 1960, with the intention to apply Labour Welfare Act and the same was further amended in 1961 and for the second time also. The question of Citizenship aroused and the voidness of the law inconsistent with the Part III of the Indian Constitution was quashed.

FACTS

Ambica Mills registered under The Companies Act, filed a writ petition in the High Court of Gujarat, the Hon’ble High Court held Section 3(1) of the Act which relates to unpaid accumulations specified in Section (2)(b), Section 3(4) and Section 6A of the Act and Rule 3 and Rule 4 of the Bombay Labour Welfare Rules were unconstitutional and void. In 1953 State of Bombay enacted Act for the labour with the purpose of welfare and financing activities. Section 19 gave powers to the state government such as to make rules and exercise them.

In the case of Bombay Dyeing and Manufacturing co. Ltd V State of Bombay AIR 1958 SC 328 the court stated that the provisions of Section 3(2)(b) are invalid on the grounds of violating the fundamental rights of the employer under Article 19(1)(f) of the Indian Constitution. After the First Amendment Act, 1961 the same Act was questioned before the Hon’ble High Court of Bombay which held the provisions to be unconstitutional.

The court rejected the contentions of the respondent with some exceptions such as.:

- The impugned provisions violated the fundamental rights of Citizen (employers and employees) under Article 19(1)(f) and therefore, the same was void under Article 13 (2) of the Indian Constitution which was held to be without authority of law.

- Section 2(4) of the act which defines ‘Establishment’ permeates through part of impugned provisions and the integral part which violates Article 14 of The Indian Constitution and were void.

ISSUES

- Whether the impugned provisions violated the fundamental rights of the citizens (employers and employees) under Article 19(1)(f)?

- Does the legislation violates Article 14 of the Indian Constitution for the purpose of discrimination in its definition of ‘establishment’?

- Whether the respondent can claim that the law was void against the non-citizen (employer and employee) under Article 13(2) without the authority of law?

ARGUMENTS

- As there was no law, notice which was issued by the Welfare Commissioner is not held to be valid.

- There is no intelligible differentia in the definition of “establishment” under Section 2(4) of the Act

- Affects the rights and liabilities of the employers and violates Article 14 of The Indian Constitution.

- The classification is unreasonable as the factories with less than 50 employees and government establishments are left out where the trams and motor omnibus establishments are included, which is unreasonable.

- The impugned provisions violated fundamental rights of citizens(employers and employees) Under Article 19(1)(f) and because of which the provisions were void under Article 13(2) of The Indian Constitution.

JUDGMENT

The impugned provisions abridged the fundamental rights of the Indian Constitution of the Citizen employers and the citizen empolyees under Article 19(1)(f), the respondent could not claim law was void as against non-citizen employers also under Article13(2) and since it is void it is the nullity of law and the prevention of its property was without the authority of law. It is settled that a Corporation is not a citizen for the purpose of Article 19 of the Constitution and there has no fundamental right.

To make the law void Article 13(1) with its extent of inconsistency with the fundamental rights and in Article 13(2) for the contravention of those rights. Therefore, Article 13(2) expresses the word void against such a person who violates the fundamental rights. The fundamental rights conferred by part III and its contravention would be void. The court also stated that even the pre-existing laws are applicable to non-citizens though the laws are held void as it violates the fundamental rights of the citizens of India. The pre-existing laws are operative with respect to non-citizens and the doctrine of eclipse is applicable only in case of pre-existing laws but not the post-constitutional laws.

Under Article 14, classification of reasonableness or unreasonableness depends upon the judicial approach.

The exclusion of the factories owned below 50 members, governmental establishments show that the accumulations obtained from them is very low and also a very few governmental institutions working with such conditions. The inclusion of tramways and motor omnibus is supported by the possibility of more sums from such establishments.

Therefore, Court came to the conclusion that the classification is not perfect but emphasis was given to practical difficulty in collection of unpaid accumulations. And also to note the clause though has classification, to go through what extent the reformation must be allowed to be determine by legislature and courts and also states that, the cannot enforce the strict regulations without considering the practical implementation of the laws.

Hon’ble Supreme court held that article 19(1)(f) of Constitution of India talks about the right to property of citizen . Ambica Mills Ltd . which is being a company held to a non -citizen .

High court’s decision in which the Act concluded to be unconstitutional which violates Ambica Mills right to property and hence the decision which given by high court in favour of Ambica mills was been overruled by Hon’ble Supreme Court .

As right to property is given to the citizens and not to the company which is non- citizen in relation between the fundamental rights and the citizenship . The Court held that non-citizens are not given the fundamental rights and therefore they are not allowed to take advantage of the voidness of the law. .

REFERENCE

This Article is written by Sakshi A Mirgal of B.C.Thakur college of Law, New Panvel (University of Mumbai), Intern at Legal Vidhiya.

0 Comments