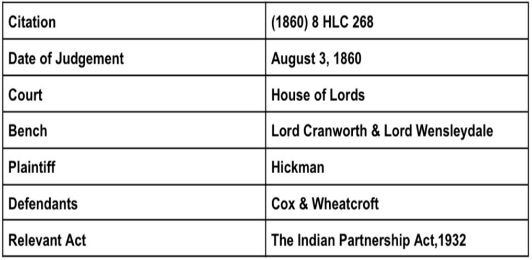

COX vs HICKMAN”

BRIEF FACTS OF THE CASE

1.Benjamin Smith and Josiah Timmis Smith carried on business under the name of B.Smith & Son. They were engaged in the business of Iron Masters and Corn Merchants.

2. They faced Financial Difficulties and losses and so called on for a meeting with their creditors. And they decided to execute a DEED OF ARRANGEMENT in favour of their creditors. As a result of the Deed Five Representatives were appointed as Trustee. Two among them were Cox & Wheatcroft.

3. The creditors mentioned that Now the responsibility of managing the business would be on the Five Trustees.

The trusts have been listed and the rental period is 21 years.

The company was to operate under the name “The Stanton Iron Company.” The deed also contains a clause preventing the Smiths from prosecuting the current debts. After six weeks after which no trustee was appointed, Cox had never functioned as trustee.

4. The Net Income from the business would be distributed to the General Creditors of Smith & Son.

Out of the Five Creditors,Cox never acted upon the Deed of Agreement and Wheatcroft resigned after Six weeks of the Deed.

5. Hickman (The Plaintiff) produced three bills of exchange that were accepted but not honored by the firm. The products were supplied for the business.

Hickman filed a Suit against Cox and Wheatcroft on those three bills and alleged that they were liable upon them as partners in the business of the Stanton Iron Company because they were two of the five creditors and had executed the deed accordingly.

6. Further Hickman also mentioned that just because the Trustees accepted Bills of Exchange he can demand the recovery of the price of the goods delivered.

ISSUES RAISED BEFORE THE COURT

1. Creditor sharing the profits of the firm of which he is not a partner in real sense.

2. Whether the creditors are liable to pay to the plaintiff the amount claimed?

3. Sharing of Profits define the Conclusive Evidence of a Partnership or not?

CONTENTION

Argument from Plaintiff’s Side

1.There was a contract of Partnership between B. Smith & Son and the Creditors under which business was to be carried out for the benefit of the creditors to pay off their debt.

2. The Creditors may engage in the company’s profits and earnings thereby making them Partners.

3. All partners are bound by the acceptance of invoices in the ordinary business process.

Argument from Defendant’s Side

1.Contention of the counsel of Wheatcroft

A) Hickman took no action even though he knew that Cox was never a trustee and Wheatcroft had resigned. The defendants were never held accountable.

B). The Smiths owned and continued to own the partnership without any changes.

C). No person can become a partner in a qualifying trade until they receive a share of the profits. There is no partnership until the profits are distributed.

2. Contention of the counsel of Cox

A)The first point is that the defendant can only be held responsible if their name is on the bill or they allowed another person to place their name on the bill.

B)The second point is that until an agency is proven, the defendant cannot be held accountable.

C)The third point is that the defendant is not responsible for the first and third points.

> The defendant is only liable if their name is on the bill or they authorized someone else to put their name on it.

> The defendant is not responsible for the first and third points, but the second point requires proof of agency before they can be held accountable.

> The defendant has the responsibility to demonstrate that the complainant is a partner.

RATIONALE & JUDGEMENT

It was decided that The Creditors were given extraordinary authority to continue trade and create norms and regulations for the exercise of trade. However, if they chose not to do business, they let the trustees continue with it.

The creditors didn’t become Commercial Partners by this act, and if they had done business, none of the trustees would have taken the bill of exchange as the directors. This is just a contract between the creditors and debtors for the repayment of current and future earnings by the creditors.

The link between the creditors and debtors is not sufficient for the principle to have a connection with the agency.

Lord Cranworth argued that the real test of partnership is whether the partners are mutual agencies. Each trading partner is a co-agent and is accountable for the other’s regular commercial contract.

The Defendants were not held liable.

REASON

1)The Trustees were acting as agents but not as Principal.

2)In Partnership the Concept of Mutual Agency is accepted. Trustees were acting in the capacity of agent and were just managing the business and not the Owner of the Business.

3)The ownership was not transferred to the trustees.

And therefore they are not the Principal/Owner but actually were the agents managing the work of the Company.

4)The Real Test of Partnership isn’t Sharing of Profits but it depends on Mutual Agency.The real intention has to be noticed.

5)And in this case it was not a case of Partnership but there was a Relationship of Debtor-Creditor.

6)And so the court finally decided in favour of the Defandants and held that Mutual Agency is the Key Element of Partnership and the Conclusive Evidence of Partnership.

CONCLUSION

1.The case is an important precedent and is applied in India too and expresses the Importance of Mutual Agency in Partnership.

According to the INDIAN PARTNERSHIP ACT,1932 mutual agency is a crucial element of partnership. It means that each partner is an agent as well as a principal. This implies that each partner has the power to bind the other partners in the firm through contracts entered into in the course of business. Each trading partner is a co-agent and is accountable for the other’s regular commercial contract.

The importance of mutual agency is that it helps to ensure that all partners are equally responsible for the actions of the firm. It also helps to ensure that the firm operates smoothly and efficiently, as each partner has the power to make decisions and take actions on behalf of the firm.

2. Mere sharing of profit doesn’t define Partnership but Mutual Agency does.

It is important to note that the mere sharing of profits is not conclusive evidence of partnership. There must be an agreement between the parties to carry on business together with a view to making a profit. This agreement can be express or implied, and it must be shown that the parties intended to share profits and losses.

In addition, the Indian Partnership Act recognizes that a partnership can be formed for a particular venture or purpose. This means that the partnership is dissolved once the venture or purpose is completed. It is important for partners to have a clear understanding of the terms of their partnership agreement, including the duration of the partnership, the sharing of profits and losses, and the roles and responsibilities of each partner. This can help to prevent misunderstandings and disputes down the line.

REFERENCES

1)Indian Case Law

2)International Journal of Advanced Legal Research

https://ijalr.in/case-analysis-cox-v-hickman-1860-8-hlc-268/

Case Analysis By Himadri Basu, LL.B Final Year Law Student from Gauhati University.

0 Comments