Introduction

According to Chris Rock ” you don’t pay taxes – they take taxes”. There are two certain things

first one is death and second is paying tax.

Tax is compulsory collection of money by the government for public purpose. Taxes are levies

by governments on their citizens to generate the revenue to be used for the welfare of public,

to raise the standard of living of its citizens and to boost the economy of the country.

In earlier times taxes where levied by kings or queen over its subject but today, Article 265 of

Indian constitution states that the rights to levy/ charge taxes hasn’t been given to any except

the authority of their.

Therefore, no tax can be levied except by the authority of law. All the taxes levied within

India must be backed by law passes by the Parliament or the state legislature. The 7th

schedule of the Constitution has defined the subject on which union/ state or both can levy

taxes.

Advantage of Good tax structure

- As tax is a compulsory collection of money by the government for public purpose, it means

that the amount of tax collect by the government will be utilized for the benefit of its people. - It help governments to reduce poverty

- To increase military expenditures

- It help government to launch various scheme for development.

- It reduce the budget deficit.

Types of Taxes

There are two types of taxes in India:

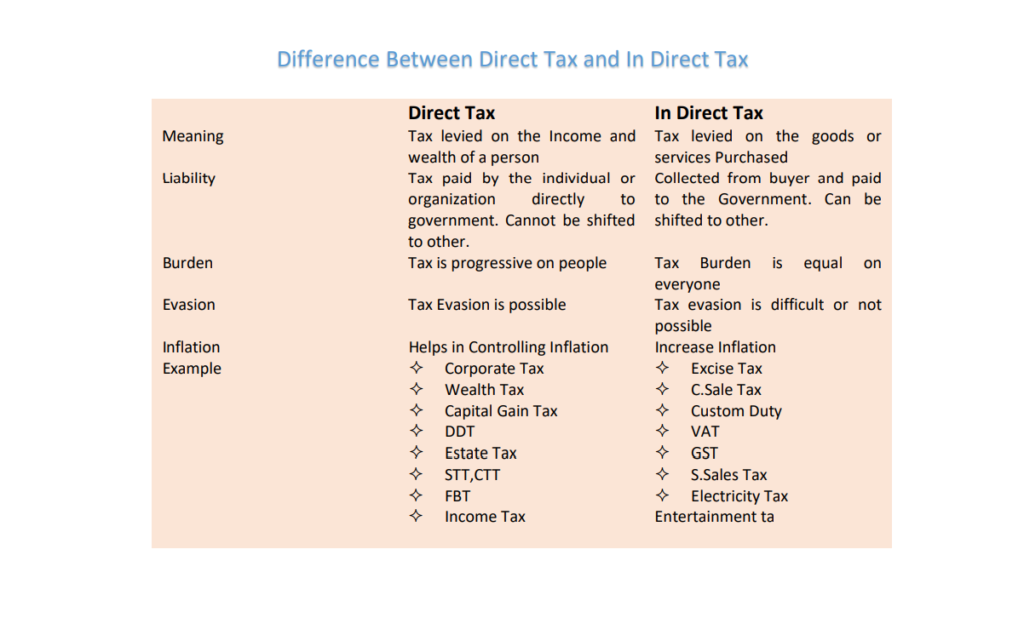

- Direct Tax

- Indirect Tax

Direct Tax

These are those tax in which point of payment and point of incident is same. So

direct taxes are those type of tax that is levied directly on an individual taxpayer or an

organization, who pays it to the government and cannot pass it to someone else.

It is levied on income, wealth, property and profit of individual or organization. Direct tax are

calculated on the ability of tax payer to pay.

Example – Income tax , Estate tax, wealth tax, etc

On the ability of tax payer to pay tax can be of two types :

- Progressive Tax

- Regressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases .The term progressive refers to the way the tax rate progresses from low to high. A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. In India we follow Progressive tax system.

Advantages of Direct Tax

- It promotes equality- As the direct tax system is based on the progressive tax method, the

tax is determined on the ability of the individual to pay. Indian is a socialist country, the role

of the government is to insure the growth of marginalized people and welfare. - It curb Inflation- Government also use taxes as a tool to curb the growing Inflation in the

economy by soaking out the money from individuals or organization. As the tax rates are

increased, it decrease the demand of commodity result to reduce in inflation. - Economical – Collection of direct taxes are economical for Government as they don’t have

to spend much and most of them are collected at the source. Many company use automatic

pay role deduction system which save time and effort. - Promotes certainty- The advantage of Direct tax is that they are determined and made final

as long as the salary and income doesn’t, the annual tax remain same every year. - Budgeting for Government- Direct taxes play a important role for the government to figure

out the total collection and help them to make budget accordingly.

Disadvantages of Direct tax

- Create social conflict– As Direct tax are not paid by everyone, it create social conflicts

among the society and lead to crime, social injustice and inferiority. - Discriminatory– Direct tax are Discriminatory in nature, they are not equally levied like

Indirect Tax, the person who earns more has to pay more as tax and person who ear less pays

less. It put the burden of government funds on the shoulder of wealthier. - Disincentive– Direct Tax are too heavy they discourage saving and investment. It infect the

growth of business and organization. And acts as danger for the country economy. - Evadable– Direct tax are submitted by payer, it is highly that they can submit false tax

return and evade the tax. If the taxes are high there is higher chance of people filing false tax

return to save tax, and if the taxes is low it would lead to fall of government revenue. This is

why direct tax is a tax of honesty.

Indirect Tax

Indirect Tax are those tax where point of payment and point of incident are not

same. These taxes are not levied directly on the income, profit or revenue of individual but

rather on the expense they incur. Indirect Taxes are levied on the seller of the commodity but

they are passed on to the buyer and hence buyer indirectly end up paying such taxes. That is

why it is said that Indirect Tax can be shifted from one person to another.

GST, Entertainment tax, electricity tax are good example of Indirect Tax.

Advantage of Indirect Tax

- They are convenient- Unlike direct tax, indirect Tax are very low and are hidden in the

price of the product, consumer doesn’t feel burden paying it. - They cannot be evaded- Direct tax is based on honesty of individual, there is higher chance

of evading of tax but indirect Tax cannot be evaded as they are part of price of the commodity

and anyone buy the commodity has to pay it. - They spread equality- As indirect Tax is equal for both rich and poor, it spread sense of

equality. They are different for different commodity, government keeps on regulating indirect Tax

according to the need & necessities of the people. - Everyone can contribute- Unlike direct tax which is paid by the certain income group,

indirect Tax is paid by everyone, thus through indirect Tax everyone can contribute to the

growth of country.

Disadvantages of Indirect Tax

- As Indirect Tax is levied on both rich and poor, rich could easily afford paying the taxes

but it becomes burden for poor to afford the goods. - As Indirect taxes are hidden in the price of a goods, it eventually lead to increase in the

price of commodity. - Indirect taxes lead to rise in inflation

- It reduce the saving of individual.

0 Comments